We're committed to building a fairer, greener Bristol where everyone can feel safe, stay well and have the opportunity to thrive. Our 2026 to 2027 budget focuses on delivering meaningful, long‑term improvements for our city, as well as investing in day to day essential services.

Bristol City Council's spending plan for 2026 to 2027 is over £850 million. This includes funding for our General Fund spending (which is used to run day to day services), long-term investments through the Capital programme and funds from specific purpose grants given to us by the UK Government and other bodies.

The General Fund budget for 2026 to 2027 is £634 million. This is funded by council tax, business rates, government grants and income we raise through some fees and charges. This money helps pay for libraries and parks, planning services, street cleaning, road maintenance, support for adults, children and families who need help, and much more. Council tax makes up £316 million of this budget and helps pay for the services many people rely on.

The largest amount of spending in our annual budget is £378 million which goes towards social care and support services for adults, families and children. This includes social care for older people, support for Disabled people, children's social care and safeguarding, support for families, and services that help people stay safe and well in their homes.

Your council tax increase of 4.99% is helping to make sure we can continue running the services people in our city value, that these services are run fairly, and help is provided when you need it. We're also changing how some of our services are run to save money and increase income.

We know the cost of living is continuing to increase and that asking households to pay more puts a further burden on you. The demand for council services is rising and costs are increasing, so we are taking steps by investing responsibly in how we:

- support children in care with appropriate placements

- help more people to live independently at home

- reduce how long it takes for children with special educational needs to receive an Education Health Care Plan

- maintain roads, bridges, parks and transportation

- support housing delivery and helping people into housing

- take action to reduce emissions and boost the environment

We're also investing in support for local community groups, funding cultural programmes for the next 3 years, and boosting street cleaning and fly tipping collection.

We have called on the government to reform the council tax system because it is outdated, unfair, and puts too much pressure on poorer households. We have retained the Council Tax Reduction Scheme which currently helps 32,000 households that are on low incomes, out of work, or retired, to pay their council tax. If you need help, call us on 0117 922 2300 or you can find out more on our Council Tax Reduction Scheme page.

Councillor Tony Dyer

Leader, Bristol City Council

Council tax pays for local services like libraries, schools, emergency services, waste and recycling collection, streetlights, social care and support services for adults, families and children, and much more.

Council tax is charged to each household in Bristol. It is based on the value of the property and not on what the household earns, so the amount of council tax you are charged depends on which property band your home is in. The band is decided by the Valuation Office. See council tax charges and bands.

Most of your council tax goes to the local authority, Bristol City Council, to spend on local services. Parts also go to the Avon and Somerset Police and Crime Commissioner and to the Avon Fire Authority.

Your final bill will be changed if you qualify for any of the council tax discounts or exemptions.

Find out more about paying the right level of council tax with GOV.UK's plain English guide to council tax.

The council also receives income from business rates and government grants, as well as fees and charges, all of which contribute towards the cost of providing council services.

Information provided with your council tax bill

The net revenue budget, which is for core day-to-day services for 2026 to 2027 is £634.1 million. We receive around 50% of our core funding from council tax. Council tax contributes £316.54 million. The 2026 to 2027 net revenue budget also includes £280 million in business rates income and £40.9 million in savings.

- gross expenditure (spending on council services, schools and welfare benefits): £1,429 million (spending by schools and on benefits is largely funded by the government)

- revenue budget (money spent on running the council and overheads): £634.1 million

- council tax contribution: £316.54 million

- council tax: 4.99% (2.99% council tax increase, 2% Adult Social Care precept)

- Avon Fire Authority increase: 5.5%

- Avon and Somerset Police and Crime Commissioner increase: 5.1%

Council services are also paid for by income from business rates, grants, service users, other organisations and our investments

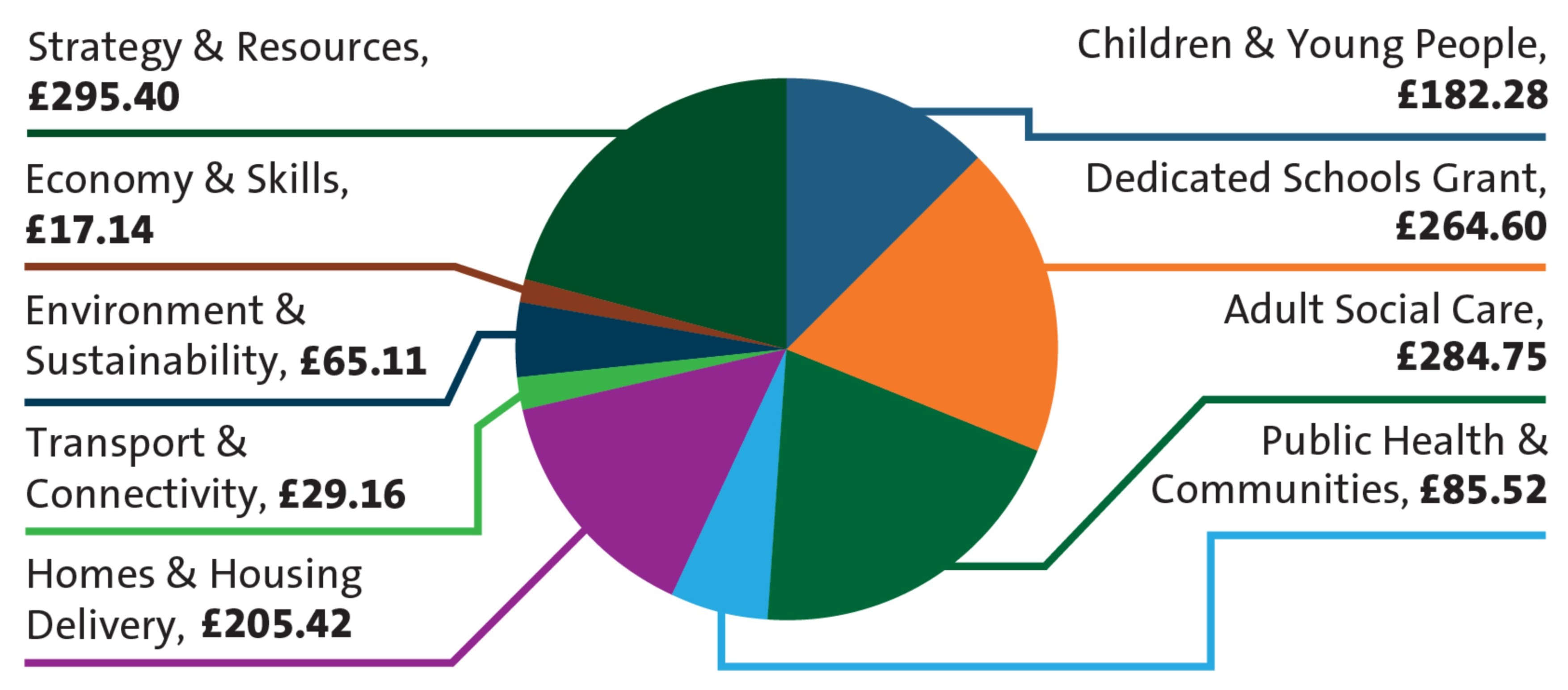

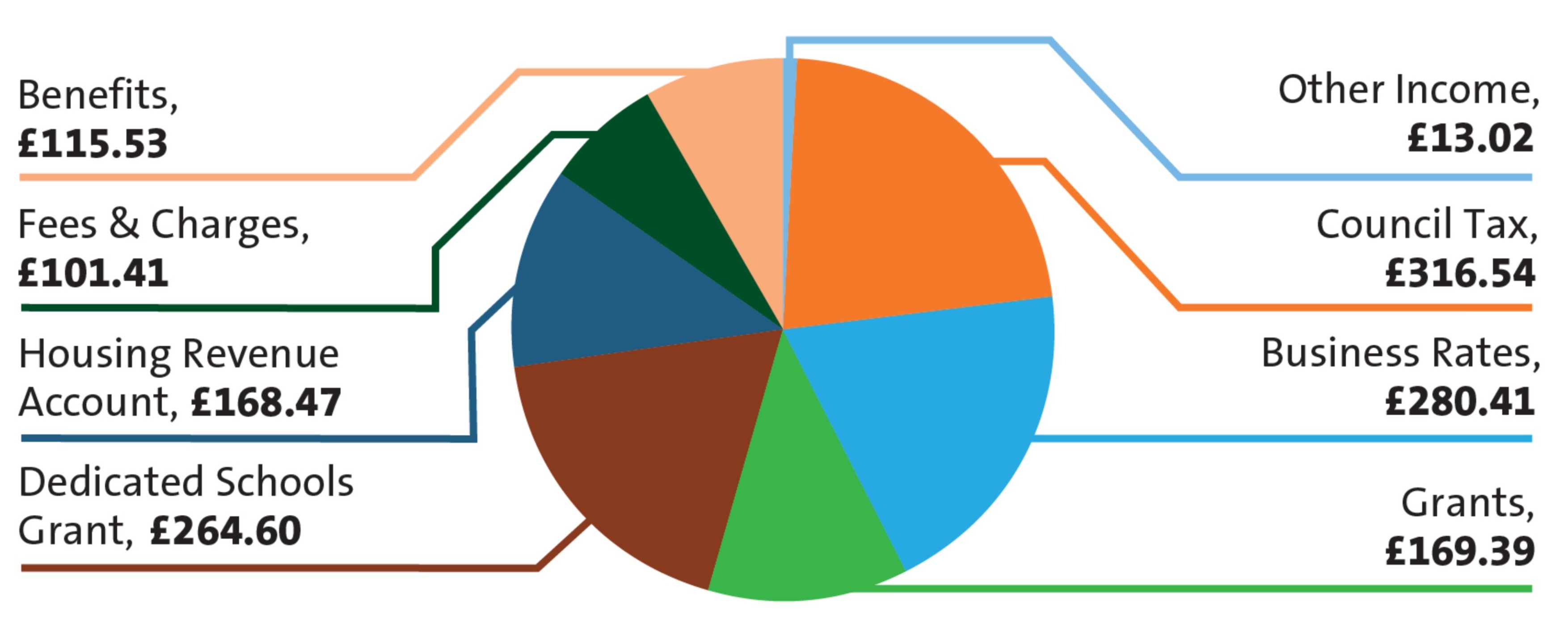

Below you can see a breakdown of where all the council's money (Gross amount) will be spent and raised in the council in the 2026 to 2027 financial year.

| Policy committee | Total gross budget (£m) |

|---|---|

| Children and Young people | £182.28 |

| Dedicated Schools Grant | £264.60 |

| Adult Social Care | £284.75 |

| Public Health and Communities | £85.52 |

| Homes and Housing Delivery | £205.42 |

| Transport and Connectivity | £29.16 |

| Enviornment and Sustainability | £65.11 |

| Economy and Skills | £17.14 |

| Strategy and Resources | £295.40 |

| Where generated | Total funding and income (£m) |

|---|---|

| Council Tax | £316.54 |

| Business Rates | £280.41 |

| Grants | £169.39 |

| Dedicated Schools Grant | £264.60 |

| Housing Revenue Account | £168.47 |

| Fees and Charges | £101.41 |

| Benefits | £115.53 |

| Other Income | £13.02 |

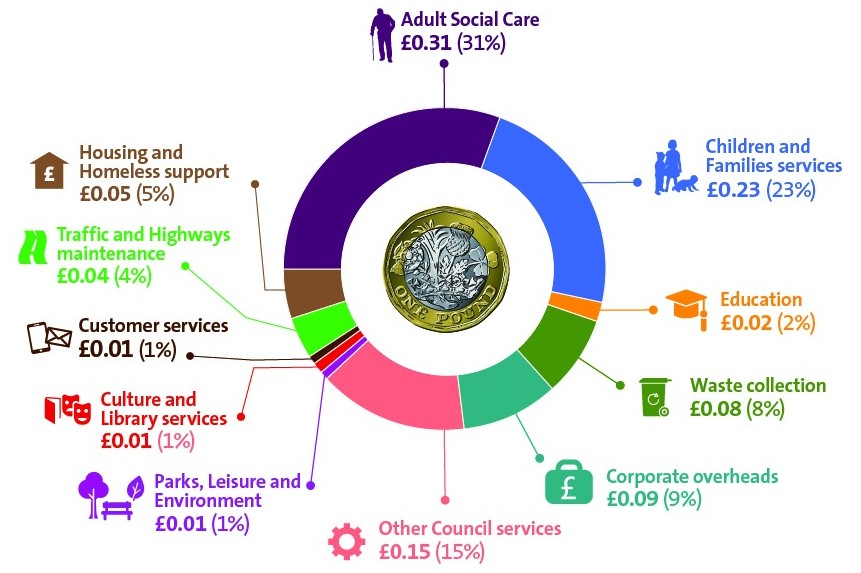

Council tax allocation per £1

Below you can see a breakdown which shows how the council typically spends each £1 of your council tax on its key services.

| Where | Council tax allocation per £1 |

|---|---|

| Adult Social Care | £0.31 |

| Children and families services | £0.23 |

| Other council services | £0.15 |

| Corporate overheads | £0.09 |

| Waste collections | £0.08 |

| Housing and homeless support | £0.05 |

| Traffic and highways maintenance | £0.04 |

| Culture and library services | £0.01 |

| Customer services | £0.01 |

| Parks, leisure and environment | £0.01 |

2025 to 2026

- Gross expenditure (spending on council services, schools and welfare benefits): £1,342 million (spending by schools and on benefits is largely funded by the government)

- Revenue budget (money spent on running the council and overheads): £571.5 million

- Council tax contribution: £299.26 million

- Council tax: 4.99% (2.99% council tax increase, 2% Adult Social Care precept)

- Avon Fire Authority increase: 5.9%

- Avon and Somerset Police and Crime Commissioner increase: 5%

2024 to 2025

- Gross expenditure (spending on council services, schools and welfare benefits): £1,260 million (spending by schools and on benefits is largely funded by the government)

- Revenue budget (money spent on running the council and overheads): £530.1 million

- Council tax contribution: £282 million

- Council tax increase: 4.99% (2.99% council tax increase, 2% Adult Social Care precept)

- Avon Fire Authority increase: 2.9%

- Avon and Somerset Police and Crime Commissioner increase: 4.9%

| Band | Ratio | Bristol City Council | Police and Crime Commissioner | Fire authority | Total |

|---|---|---|---|---|---|

| A | 6/9 | £1,50.03 | £205.47 | £63.62 | £1,809.12 |

| B | 7/9 | £1,796.7 | £239.71 | £74.22 | £2,110.64 |

| C | 8/9 | £2,053.38 | £273.96 | £84.83 | £2,412.17 |

| D | 9/9 | £2,310.05 | £308.20 | £95.43 | £2,713.68 |

| E | 11/9 | £2,823.39 | £376.69 | £116.64 | £3,316.72 |

| F | 13/9 | £3,336.74 | £445.18 | £137.84 | £3,919.76 |

| G | 15/9 | £3,850.08 | £513.67 | £159.05 | £4,522.80 |

| H | 18/9 | £4,620.10 | £616.40 | £190.86 | £5,427.36 |

For previous years council tax charges and bands and how to appeal if you think your band is wrong, see council tax charges and bands.

The Environment Agency (EA) and the Lower Severn Internal Drainage Board (IDB) charge the council a levy for flood defence and land drainage. The Devon and Severn Inshore Fisheries and Conservation Authority (IFCA) charge a levy for the management of the local marine environment. The Regional Flood and Coastal Committees (RFCC) charge a levy to fund local flood and coastal priorities.

| Region | Gross expenditure (£m) | Total levy requirement (£m) | Levy on the council (£) |

|---|---|---|---|

| EA Severn and Wye RFCC | 20.8 | 1.3 | 3,726 |

| EA Wessex RFCC | 131.4 | 4.3 | 511,031 |

| Lower Severn IDB | 2.3 | 2 | 1,062,517 |

| Devon and Severn IFCA | 0.96 | 0.9 | 50,664 |

| Region | Gross expenditure (£m) | Total levy requirement | Levy on the council (£) |

|---|---|---|---|

| EA Severn and Wye RFCC | 32.6 | 1.3 | 3,636 |

| EA Wessex RFCC | 138.6 | 4.2 | 503,180 |

| Lower Severn IDB | 2.1 | 1.9 | 1,016,980 |

| Devon and Severn IFCA | 0.96 | 0.84 | 47,350 |

| Region | Gross expenditure (£m) | Total levy requirement (£m) | Levy on the council (£) |

|---|---|---|---|

| EA Severn and Wye RFCC | 33.4 | 1.27 | 3,335 |

| EA Wessex RFCC | 137.6 | 4.1 | 499,693 |

| Lower Severn IDB | 2.0 | 1.8 | 948,676 |

| Devon and Severn IFCA | 0.94 | 0.79 | 44,356 |

The pdf Council Tax Notice for 2026 to 2027(114 KB) shows the council tax bands commencing from 1 April 2026.

Previous notices

Get information on spending plans for the Police and fire brigade and details of how the budgets are finalised:

2026 to 2027

- pdf Avon and Somerset Police and Crime Commissioner 2026 to 2027(449 KB)

- pdf Avon Fire Authority: Your fire and rescue service 2026 to 2027(331 KB)

2025 to 2026

- pdf Avon and Somerset Police and Crime Commissioner 2025 to 2026(891 KB)

- pdf Avon Fire Authority: Your fire and rescue service 2025 to 2026(442 KB)